- Risk & Return

- Posts

- The St. Joe Company: Free Land and a Growing Business

The St. Joe Company: Free Land and a Growing Business

👋🏻 The last time I wrote you was about Sable Offshore (SOC), and now that we’re up 60% and oil is starting to flow I can refocus on value traps that trade like homebuilders. Jokes aside (am I joking?), it’s good to be back.

A Week on From Memorial Day: Thank you to all of those who served and/or knew someone who died while serving the U.S. Armed Forces.

Disclaimer: This report is for informational purposes only and should not be considered as financial advice or a recommendation to buy, sell, or hold any securities. The analysis and opinions expressed in this report are solely those of the author and are based on publicly available information. All investments carry risk, and readers should conduct their own research or consult with a qualified financial advisor before making any investment decisions. The author of this report assumes no responsibility for any losses or damages resulting from the use of this information. The information provided is accurate to the best of the author's knowledge at the time of publication but is subject to change without notice. Past performance is not indicative of future results.

Name / Ticker: The St. Joe Company (NYSE: JOE)

Investment Type: Long Term Hold / Deep-Value

Today’s Price: $44.71

Price Target: $90+

What’s the Story?

I’ve tried to find a reason not to buy shares of St. Joe. You could argue it’s a classic land bank trap (167,000 acres). You could argue the land is worthless, as Kerrisdale did in a short report back in 2018. The P/E is sky high (technically). You could look at the stock price over the last 20 years and think “Yikes”. But after studying St. Joe off and on the past 4 months, I can no longer ignore how cheap it is. It’s free land, a growing business and a hedge all rolled into one.

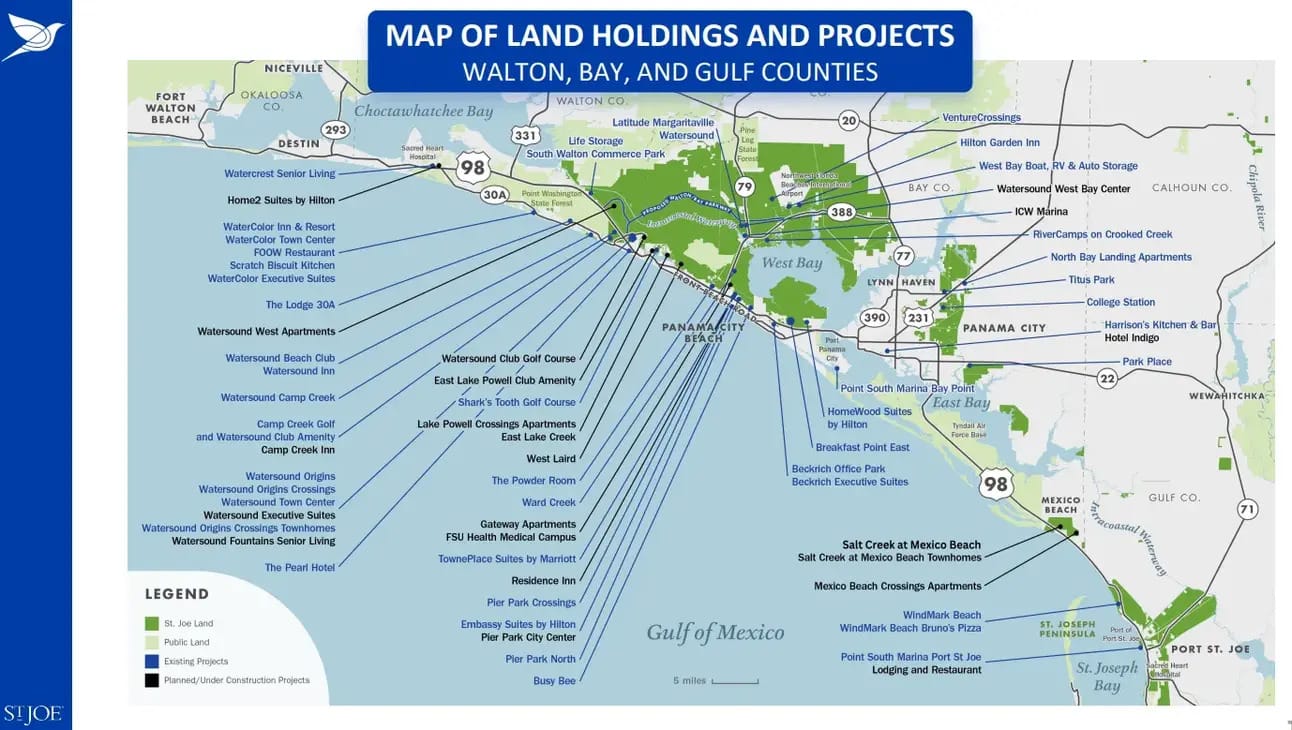

The map above depicts St. Joe’s current land holdings in dark green, completed commercial properties in blue and planned developments in black. Although, some of the projects in black are already complete. Before we discuss what St. Joe is today and where it’s headed, let’s first understand its history…